The employment allowance 2025/26 UK has undergone its most significant transformation since inception, doubling from £5,000 to £10,500 and removing the controversial £100,000 cap. This comprehensive guide breaks down everything UK employers need to know about claiming this substantial tax relief in the current tax year.

Tip: Get interview-ready faster with our AI Interview Coach. Practice real, job-specific interview questions, receive instant, actionable feedback, and build confidence through realistic interview simulations—anytime, anywhere.

What is Employment Allowance 2025/26?

The Employment Allowance is a government relief scheme designed to reduce employment costs and encourage businesses to hire staff. For the 2025/26 tax year (running from 6 April 2025 to 5 April 2026), eligible employers and charities can reduce their annual secondary Class 1 National Insurance contributions by up to £10,500.

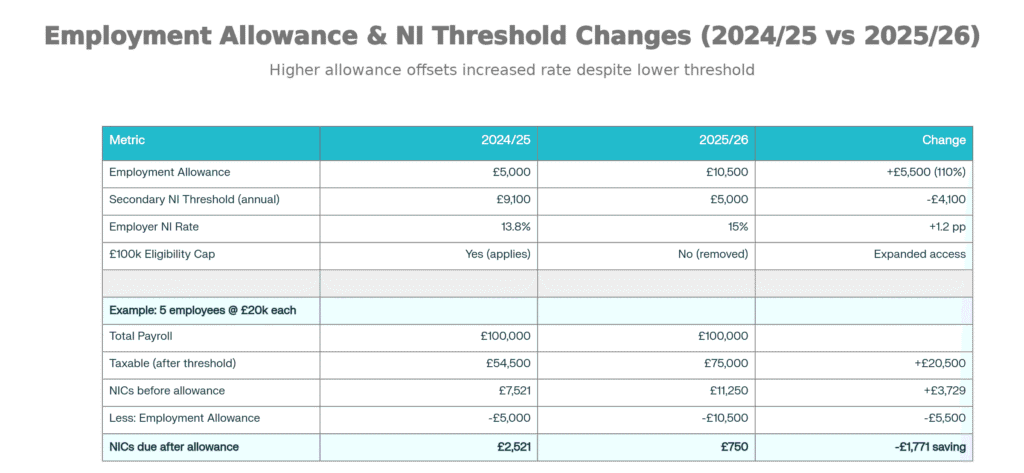

This represents a 110% increase from the previous £5,000 allowance, making it one of the most valuable tax benefits available to UK businesses today. The enhanced allowance was introduced to offset the combined impact of increased employer National Insurance contributions and a lowered secondary threshold announced in the Autumn Budget 2024.

Major Changes for 2025/26: What You Need to Know

The current tax year introduced four interconnected changes that fundamentally reshape employer National Insurance obligations:

1. Employment Allowance Doubled to £10,500

The allowance increased from £5,000 to £10,500—the most generous amount since the scheme’s inception. For many small and medium-sized businesses, this increase provides transformational cash relief that can offset 50-90% of their entire annual NI liability.

2. £100,000 Cap Completely Removed

Previously, employers with Class 1 National Insurance liabilities exceeding £100,000 in the prior tax year were automatically disqualified. This restriction has been eliminated, allowing larger employers, charities, and community sports clubs to access the allowance for the first time.

3. Employer NI Rate Increased to 15%

The employer (secondary) National Insurance rate rose from 13.8% to 15%—an increase of 1.2 percentage points. This adds high costs for businesses across all payroll sizes.

4. Secondary Threshold Reduced to £5,000

The secondary threshold—the earnings level at which employers begin paying NI—dropped dramatically from £9,100 to £5,000 annually (£417 monthly or £96 weekly). This threshold is frozen until 5 April 2028, after which it will rise in line with the Consumer Price Index.

[Image Placeholder: Comparison Table – 2024/25 vs 2025/26 Changes]

Employment Allowance 2025/26 Eligibility: Can You Claim?

Understanding eligibility is crucial for maximizing this relief. The employment allowance 2025/26 UK has specific requirements that must be met:

Core Eligibility Requirements

To claim, your business must satisfy these fundamental conditions:

Business Structure Requirements:

- Registered as an employer with HMRC

- Operating as a limited company, sole trader, partnership, charity, or community amateur sports club

- Individuals employing care or support workers (such as disability support assistants)

Public Sector Test:

- Must do less than 50% of work in the public sector (local councils, NHS services, public bodies)

- This restriction does not apply to registered charities

Employee Threshold Test:

The rules vary significantly by business structure:

Limited Companies: For companies with directors and employees, at least two of the following must apply during the tax year:

- Single director company: At least one other employee (not a director) must earn above the secondary threshold of £5,000 per year

- Multiple directors: At least two directors must earn above the secondary threshold, OR at least one non-director employee must earn above the threshold

Single-Director Companies – Critical Restriction: A company where the sole director is the only employee above the secondary NI threshold cannot claim the allowance. This affects many sole proprietor limited companies. However, hiring even one additional employee earning above £5,000 per year makes the company eligible for the entire tax year—even if that employee later leaves.

Partnerships and Sole Traders: Can claim if they employ at least one person and pay Class 1 NICs.

Charities: Can claim if they meet core requirements, though some de minimis state aid rules may apply in Northern Ireland for certain sectors.

Who Cannot Claim: Absolute Exclusions

Certain employers are automatically disqualified:

Excluded Employees:

- Off-payroll workers (IR35 contractors)—their earnings cannot be included in calculations

- Individuals employed for personal, household, or domestic work (nannies, gardeners, housekeepers)—unless classified as care or support workers

Other Exclusions:

- Employers doing more than 50% of work in the public sector (unless a registered charity)

- Single-earner companies where the only employee above the threshold is a director

- Sole traders without any employees

[Image Placeholder: Employment Allowance Eligibility Flowchart]

Connected Companies and Group Restrictions

This is a critical rule for multi-company operations: where two or more companies are connected at the start of the tax year (6 April), only one company in the group can claim the Employment Allowance for 2025/26.

What Makes Companies “Connected”?

Companies are considered connected if:

- One company has control over another

- Both companies are under the control of the same person or persons (common shareholding)

- Related in a group structure with majority shareholding (over 50%) held by the same entity

Substantial Commercial Interdependence Test

Where companies are only connected through attribution of rights between associates (family members, relatives), they’re only treated as connected for Employment Allowance if they demonstrate:

- Shared financial support between entities

- Common economic or commercial objectives

- Shared management, employees, or premises

- Significant organizational ties

Important Note: If an employer operates multiple PAYE schemes, the allowance can only be claimed against a single scheme. Groups must strategically decide which entity claims to maximize utilization—typically the company with the largest NI liability.

How Much Can You Save? Understanding the Calculations

Maximum Relief: £10,500 Per Tax Year

The allowance provides up to £10,500 in relief per employer per tax year, allocated to the year as a whole regardless of when claimed.

How Employment Allowance Works in Practice

The allowance automatically reduces your Class 1 secondary National Insurance liability each time you process payroll until either:

- The full £10,500 has been offset against NI payments, or

- The tax year ends on 5 April 2026

Critical Point: Any unused allowance at year-end is forfeited and cannot be carried forward to 2026/27.

Real-World Examples

Example 1: Micro-Business with 5 Employees

Let’s examine a company with 5 employees earning £20,000 each (total payroll £100,000):

- Total earnings above threshold = £100,000 – (5 × £5,000) = £75,000

- Employer NI before allowance = £75,000 × 15% = £11,250

- After claiming £10,500 allowance = £750 only due to HMRC

This means the allowance offsets approximately 93% of the NI liability.

Example 2: Single Employee Above Threshold

Employee earning £20,000 per year:

- Earnings above secondary threshold = £20,000 – £5,000 = £15,000

- Employer NI at 15% = £15,000 × 0.15 = £2,250 per annum

With the allowance, this entire amount would be covered, plus the employer would have £8,250 remaining to offset other employees’ NI contributions.

How to Claim Employment Allowance 2025/26: Step-by-Step Guide

Annual Requirement: Must Claim Every Year

The employment allowance 2025/26 UK must be claimed every tax year. Even if you claimed previously, you must actively resubmit each April to maintain eligibility.

Two Methods to Claim

Method 1: Via Payroll Software (Recommended for most employers)

Most employers use commercial payroll software such as Xero, Sage, QuickBooks, or BrightPay. The process is straightforward:

- Verify eligibility – Confirm your business meets all requirements

- Locate the Employment Allowance indicator – Find this field in your payroll software settings

- Select ‘Yes’ to claim – Activate the allowance feature

- Submit the Employer Payment Summary (EPS) – Include with your next payroll run

Method 2: Via HMRC Basic PAYE Tools (For smaller employers with fewer than 10 employees)

- Log in to HMRC Basic PAYE Tools

- Select your employer name from the menu

- Select the ‘Employment Allowance’ option

- Confirm you meet the eligibility criteria

- For de minimis state aid: Select whether state aid rules apply (for 2025/26, most employers should select “State aid rules do not apply to employer”)

- Submit the EPS as normal

Timing and Deadlines

- When to claim: Anytime during the tax year (April 2025 to April 2026)

- Benefit of early claiming: Accelerates cash benefit throughout the year

- EPS deadline: For the allowance to reduce a specific month’s payroll, submit the EPS by the 19th of the following month

Pro Tip: Claiming in April or May maximizes your cash flow benefit across the entire year.

Claiming for Previous Tax Years: Backdating Opportunities

If you missed claiming in previous years, you have a valuable opportunity to recover substantial sums.

Backdating Period: Up to Four Years

You can currently claim for:

- 2021/22 tax year – Deadline: 5 April 2026 ⚠️ Expires Soon

- 2022/23 tax year – Deadline: 5 April 2027

- 2023/24 tax year – Deadline: 5 April 2028

- 2024/25 tax year – Deadline: 5 April 2029

Process for Backdating

A separate EPS must be submitted for each prior year claim. This represents a potential recovery of £4,000 to £20,000, depending on:

- Number of years claimed

- Average payroll size

- Prior year allowance amounts (£4,000 for 2021/22, £5,000 for 2022/23-2024/25)

Action Required: If eligible for 2021/22, prioritize this claim before the April 2026 deadline.

[Image Placeholder: Backdating Deadlines Timeline]

Record Keeping and Compliance Requirements

Mandatory Documentation (Minimum 3 Years Retention)

Employers must maintain records proving eligibility for at least three years after the end of the tax year in which the allowance was claimed:

Essential Records:

- Documented proof of employment structure

- Employee details and earnings records

- Evidence that earnings thresholds were met

- Monthly/quarterly NI calculations

- How much allowance was used in each payroll period

- What liabilities did the allowance cover

For Connected Companies:

- Documentation showing which entity claimed

- Rationale for the claiming entity selection

- Proof of connection or independence

Additional Documentation:

- Any correspondence with HMRC regarding eligibility

- Payroll software reports showing allowance usage

- Employee contracts

- PAYE records

Pro Tip: Most payroll software provides downloadable reports showing allowance usage. Combined with payroll records and employee contracts, these constitute adequate proof.

Special Cases and Considerations

Charities and Community Amateur Sports Clubs (CASC)

Charities face relaxed restrictions compared to commercial entities:

- Can claim if they employ staff and pay Class 1 NICs

- No cap on NI liabilities

- Must not do more than 50% of work in the public sector

- Northern Ireland charities may need to monitor de minimis state aid limits depending on the sector

The removal of the £100,000 cap particularly benefits larger charities and community sports clubs previously excluded.

Care and Support Workers

Individuals employing a single care or support worker (such as a personal care assistant for someone with physical or mental disability) can claim the allowance even with just one employee, provided that the employee is classified as a care or support worker.

This is an important exception to the usual single-employee company restriction.

Directors’ Salaries and State Pension Implications

A common tax-efficient salary strategy involves paying a director £12,570 (the Personal Allowance threshold) to avoid income tax and employee NICs. However:

The Challenge:

- Company still pays employer NICs: £12,570 – £5,000 = £7,570 × 15% = £1,135.50 per director

- But if only one director is paid above £5,000 with no employees above that threshold, the company cannot claim the allowance

State Pension Consideration:

- To qualify for the state pension, directors must earn at least £6,500 per year (52 × £125 lower earnings limit)

- The £12,570 salary satisfies this requirement

Strategic Solution: Consider hiring at least one additional employee above the £5,000 threshold to unlock the full £10,500 allowance benefit.

Mid-Year Changes in Circumstances

Hiring Employees During the Year: If you hire a second employee mid-year who earns above the secondary threshold, your company becomes eligible for the allowance for the remainder of that year, and the allowance applies from the beginning of the tax year (not the hire date).

Dismissing Employees: If eligibility changes during the tax year (e.g., an employee is dismissed), you retain the allowance for the entire year if you were eligible at the start. Eligibility for the following year will be reassessed based on circumstances on 6 April 2026.

Common Mistakes and How to Avoid Them

1. Failing to Claim Annually

The Mistake: Assuming once claimed, the allowance continues automatically.

The Reality: A fresh claim is required each tax year through your EPS submission.

How to Avoid: Set a calendar reminder for early April each year to activate the allowance in your payroll software.

2. Misunderstanding Connected Company Rules

The Mistake: Groups with multiple entities claiming the allowance for each company.

The Reality: Only one entity in a connected group can claim the full £10,500.

How to Avoid: Review your group structure annually and designate which company will claim. HMRC increasingly audits such errors, resulting in reclaim notices plus interest.

3. Forgetting the Four-Year Backdating Option

The Mistake: Not claiming for eligible previous years.

The Reality: You can recover potentially £4,000-£20,000 depending on the years and payroll.

How to Avoid: Review your eligibility for tax years 2021/22 through 2024/25 immediately. The 2021/22 deadline expires in April 2026.

4. Including Ineligible Employees

The Mistake: Including IR35 contractors or domestic workers in the claim.

The Reality: These employees cannot be included and may lead to disallowance and penalties.

How to Avoid: Carefully review employee classifications and exclude off-payroll workers and domestic staff (unless they’re care or support workers).

5. Not Reviewing Eligibility Annually

The Mistake: Assuming eligibility remains constant year-to-year.

The Reality: Circumstances change—directors resign, employees are hired or dismissed, business structures evolve.

How to Avoid: Conduct an annual eligibility review each April before claiming.

6. Underutilizing the Allowance

The Mistake: Claiming late in the tax year or forgetting to claim entirely.

The Reality: Any unused allowance at year-end is forfeited with no carryover.

How to Avoid: Claim in April or May to maximize cash flow benefit throughout the entire year.

[Image Placeholder: Common Mistakes Infographic]

Strategic Considerations for Maximizing Employment Allowance

1. Timing of Employment Decisions

The allowance structure incentivizes bringing employees above the £5,000 threshold:

- Employing someone at £4,900 generates no NI benefit and no allowance eligibility

- At £5,100, the company incurs 15% NI on the excess £100 but becomes eligible for £10,500 in relief (if other conditions are met)

2. Group Structure Optimization

For businesses organized as multiple connected entities, carefully consider which company should claim:

Best Practice: The company with the largest NI liability should typically claim to maximize utilization of the £10,500 allowance.

Example: If Company A has £3,000 NI liability and Company B has £12,000 NI liability, Company B should claim to utilize more of the allowance.

3. Salary Strategy for Owner-Managed Companies

For owner-managed companies, the optimal director salary depends on multiple factors:

- Personal allowance threshold (£12,570)

- State pension qualifying earnings (£6,500 minimum)

- Corporation tax rates

- Dividend allowance

- The employment allowance benefit

Consideration: Factor the £10,500 allowance into tax planning calculations, especially if planning to hire additional staff.

Impact on Different Business Sizes

Micro-Businesses (1-5 Employees)

Impact: For businesses with a handful of staff earning average salaries (£20,000-£30,000), the £10,500 allowance typically covers 50-90% of their entire annual NI liability, providing transformational cash relief.

Example Business Profile:

- 3 employees at £25,000 each

- Total payroll: £75,000

- Total NI liability: (£75,000 – £15,000) × 15% = £9,000

- After allowance: £0 NI due (full relief + £1,500 unused)

Small-to-Medium Enterprises (6-50 Employees)

Impact: For SMEs with modest payroll bills (£200,000-£500,000), the allowance offsets a meaningful 5-15% of NI liability, freeing capital for reinvestment.

Example Business Profile:

- 20 employees at £30,000 each

- Total payroll: £600,000

- Total NI liability: (£600,000 – £100,000) × 15% = £75,000

- After allowance: £64,500 NI due (£10,500 saved, 14% reduction)

Larger Employers (Previously Excluded)

Impact: With the cap removed, even large employers benefit from the £10,500 offset. Previously excluded employers with £150,000+ NI liabilities can now claim.

Example Business Profile:

- 100 employees at £35,000 each

- Total payroll: £3,500,000

- Total NI liability: (£3,500,000 – £500,000) × 15% = £450,000

- After allowance: £439,500 NI due (£10,500 saved, 2.3% reduction)

While the percentage savings are smaller, the absolute £10,500 relief remains valuable.

Charities and CASC

Impact: The removal of the cap particularly benefits larger charities and community sports clubs that were previously excluded. Many can now access the relief for the first time.

[Image Placeholder: Business Size Impact Comparison Chart]

De Minimis State Aid and Regulatory Considerations

Key Change for 2025/26

From 2025/26 onwards, Employment Allowance no longer counts as de minimis state aid for most businesses, simplifying the compliance burden that previously applied in Northern Ireland to businesses manufacturing or selling goods.

Historical Context (2024/25 and Earlier)

For the 2024/25 tax year and earlier, businesses in Northern Ireland that received state aid in other forms needed to verify they remained below sector limits. This is no longer required for the employment allowance, specifically from 2025/26.

Remaining Considerations

Employers in Northern Ireland operating in manufacturing, goods sales, or other regulated sectors should continue monitoring if they receive other forms of government support, as accumulated state aid (including any future reinstatement of Employment Allowance as state aid) must not exceed sector limits over any three-year rolling period.

Employment Allowance 2025/26: Quick Reference Guide

Key Facts at a Glance

| Aspect | Details |

|---|---|

| Allowance Amount | £10,500 per tax year |

| Tax Year | 6 April 2025 to 5 April 2026 |

| Employer NI Rate | 15% |

| Secondary Threshold | £5,000 annually (£417 monthly, £96 weekly) |

| £100k Cap | Removed (no longer applies) |

| Claim Method | Via EPS through payroll software or HMRC Basic PAYE Tools |

| Annual Requirement | Must claim fresh each tax year |

| Carryover | None – unused allowance forfeited at year-end |

| Backdating | Up to 4 previous tax years |

| Record Retention | Minimum 3 years after tax year end |

Critical Deadlines

| 19th of the following month | Deadline |

|---|---|

| Claim for 2025/26 | 5 April 2026 (earlier claiming preferable) |

| Claim for 2021/22 (backdate) | 5 April 2026 ⚠️ Expiring Soon |

| Claim for 2022/23 (backdate) | 5 April 2027 |

| Claim for 2023/24 (backdate) | 5 April 2028 |

| Claim for 2024/25 (backdate) | 5 April 2029 |

| EPS submission for monthly payroll | 19th of following month |

Frequently Asked Questions (FAQs)

1. Can a single director company claim the employment allowance 2025/26 UK?

No, a company where the sole director is the only employee earning above the £5,000 secondary threshold cannot claim. However, if you hire even one additional employee earning above £5,000 per year, your company becomes eligible for the entire tax year, even if that employee later leaves.

2. Do I need to claim employment allowance every year?

Yes, absolutely. The employment allowance 2025/26 UK must be claimed every tax year through your Employer Payment Summary (EPS). Even if you claimed in previous years, the allowance does not continue automatically—you must actively resubmit your claim each April.

3. Can connected companies each claim the £10,500 allowance?

No. Where two or more companies are connected at the start of the tax year (6 April), only one company in the group can claim the Employment Allowance. The company with the largest NI liability should typically claim to maximize utilization.

4. What happens if I don’t use the full £10,500 allowance?

Any unused allowance at the end of the tax year (5 April 2026) is forfeited and cannot be carried forward to the following year. This makes it important to claim early in the tax year and ensure you’re maximizing the benefit.

5. Can I claim employment allowance for previous tax years?

Yes, you can backdate claims for up to four previous tax years. Currently, you can claim for 2021/22 (deadline: 5 April 2026 – expiring soon), 2022/23, 2023/24, and 2024/25. A separate EPS must be submitted for each prior year, potentially recovering £4,000-£20,000 depending on circumstances.

Conclusion: Maximizing Your Employment Allowance 2025/26 UK Benefit

The employment allowance 2025/26 UK represents one of the most substantial business support enhancements in recent years. With the allowance doubling to £10,500 and the removal of the £100,000 cap, more businesses than ever can access meaningful National Insurance relief.

Key Takeaways:

- Act Now: Claim early in the tax year (April/May) to maximize cash flow benefits

- Review Eligibility: Carefully assess your business structure, employee thresholds, and connected company status

- Backdate if Eligible: Check if you can claim for previous years (especially 2021/22 before April 2026 deadline)

- Document Everything: Maintain comprehensive records for at least 3 years

- Plan Strategically: Factor the allowance into hiring decisions, salary structures, and group optimization

Don’t Leave Money on the Table

With up to £10,500 in potential relief per employer per year, the employment allowance 2025/26 UK represents a critical opportunity for small and medium-sized UK businesses to reduce employment costs and free up capital for growth and investment.

Verify your eligibility today, submit your claim through your payroll software or HMRC Basic PAYE Tools, and ensure you’re maximizing this valuable tax benefit.

References:

This comprehensive guide draws on authoritative sources, including:

- HMRC Official Guidance on Employment Allowance Eligibility

- HMRC Rates and Thresholds for Employers 2025-2026

- HMRC Employment Allowance Detailed Guidance

- ICAEW Tax Guidance on Single Director Companies

- ICAEW Connected Companies Guidance

Disclaimer: This guide provides general information and should not be considered as financial or legal advice. Tax circumstances vary by individual business. Consult with a qualified accountant or tax advisor for specific guidance on your situation.