The consumer services sector stands as one of America’s largest employment engines, providing jobs for approximately 140 million workers—representing 79% of the entire U.S. workforce. But with such massive scale comes an important question many professionals are asking today: Is Consumer Services a Good Career Path for the long term?

If you’re considering entering this field, you’re looking at a sector that’s both remarkably accessible and increasingly complex. The industry spans everything from retail and hospitality to financial services and healthcare, offering approximately 9.1 million current job openings across the United States. Yet beneath these impressive numbers lies a more nuanced reality involving automation risks, burnout challenges, and wide salary disparities across roles and specializations.

This comprehensive guide cuts through the noise to deliver what you actually need to know. We’ll explore real salary data, identify which consumer services roles offer the strongest growth and stability, and evaluate whether this sector aligns with your long-term career goals. Whether you’re a recent graduate, career changer, or experienced professional seeking advancement, this analysis will help you decide if consumer services truly make sense for your future.

Pro Tip: Prepare for your next job interview with our AI Interview Coach. It’s your 24/7 personal simulator to practice real questions and get instant feedback.

What is Consumer Services? Understanding the Sector

Consumer services refer to services provided directly to individuals rather than organizations, designed to address specific consumer needs and enhance daily experiences. Unlike tangible products, these services derive value from intangible elements, including experiences, outcomes, and personalized interactions.

The sector’s breadth is remarkable. Consumer services encompass virtually any service-based interaction where a company or professional assists an individual customer. This ranges from a barista preparing your morning coffee to a financial advisor managing your investment portfolio.

Major Industries Within Consumer Services

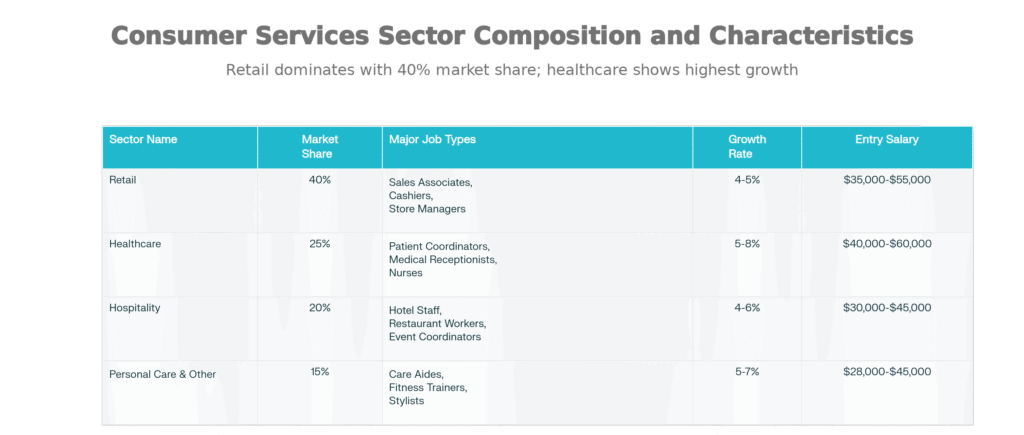

The consumer services sector breaks down into eight primary categories:

Retail and E-commerce: Both traditional brick-and-mortar stores and online platforms. Industry giants like Walmart employ 2.3 million people with $635 billion in annual revenue, while Amazon operates with 1.6 million employees generating $525 billion.

Hospitality and Travel: Hotels, restaurants, tourism operations, and event management facilities. This sector currently shows 1.4 million job openings nationwide, reflecting a strong post-pandemic recovery.

Healthcare and Wellness: Patient services, medical administration, wellness coaching, and telehealth platforms. Healthcare and social assistance are projected to add 2.1 million jobs over the coming decade—representing approximately 45% of all new US employment growth.

Financial Services: Banking, insurance, investment management, and financial advisory. This subsector commands premium compensation, with average annual salaries ranging from $120,000-$150,000 for specialized roles.

Education and Training: Universities, online learning platforms, tutoring services, and professional development programs continue expanding, driven by lifelong learning trends.

Professional Services: Legal advice, accounting, consulting, and real estate services requiring specialized expertise.

Entertainment and Leisure: Streaming services, gaming, museums, fitness facilities, and recreational activities.

Technology and IT Support: Cloud services, technical support, software-as-a-service, and digital solutions enabling modern business operations.

The US consumer services market reached $3.7 trillion in 2024, representing 30% of the global total and demonstrating the sector’s economic significance.

How Many Jobs Are Available in Consumer Services?

Understanding job availability provides crucial context for career planning. The consumer services sector demonstrates remarkable employment breadth, though opportunities vary significantly by specialization and geography.

Current Employment Landscape

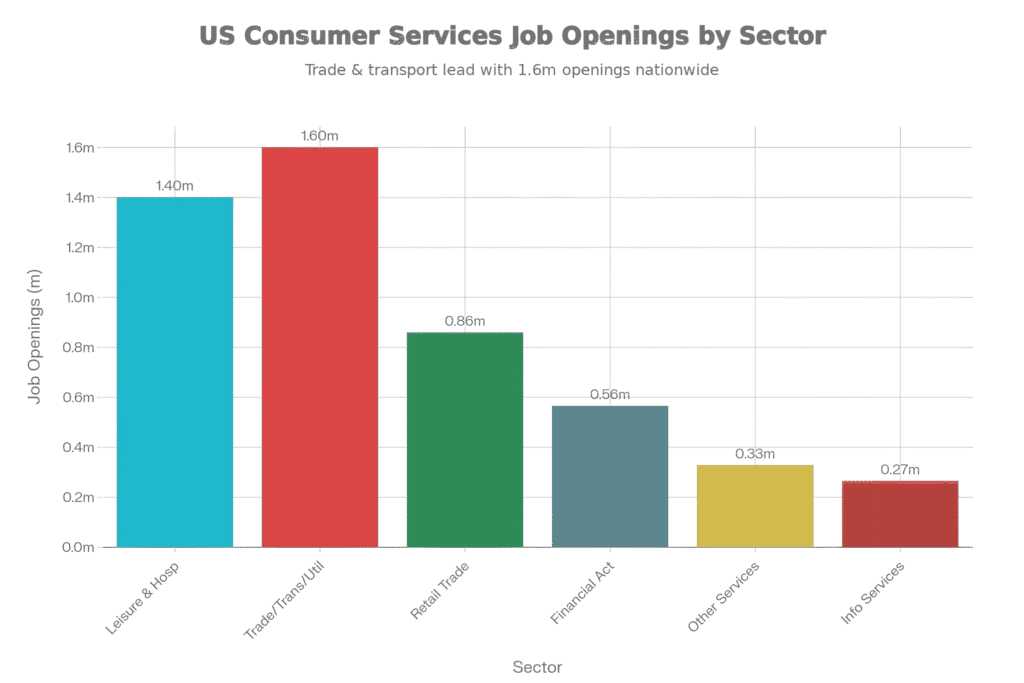

As of 2025, the consumer services sector shows approximately 9-9.1 million open positions across the United States. This distribution reveals interesting patterns:

- Trade, Transportation, and Utilities: 1.6 million openings

- Leisure and Hospitality: 1.4 million openings

- Retail Trade: 859,000 openings

- Financial Activities: 565,000 openings

- Other Services: 328,000 openings

- Information Services: 265,000 openings

Within customer service specifically, there were 2.95 million dedicated customer service representative positions in 2023, with a median annual salary of $39,680.

Geographic Opportunity Variations

Job availability isn’t uniform across the United States. Nevada, Colorado, Minnesota, North Carolina, South Carolina, and Arkansas experienced 70-100% increases in consumer services job openings from 2020 to 2023, while the Northeast, Plains states, and West Coast saw more modest 10-39% increases.

Major metropolitan areas demonstrate particular concentration. New York City employed over 450,000 people in leisure and hospitality alone by 2024, while the Washington-Arlington-Alexandria region showed 20.6% of nonfarm employment concentrated in professional and technical services.

This geographic variation creates strategic opportunities. Entry-level professionals in high-growth regions face less competition and often find faster advancement pathways compared to saturated coastal markets.

Examples of Consumer Services Careers and Salary Ranges

Consumer services careers span an exceptionally diverse spectrum, from entry-level positions requiring minimal experience to specialized roles commanding six-figure compensation.

Entry-Level Positions ($30,000-$50,000 annually)

Starting positions provide accessible entry points with minimal educational barriers:

- Customer Service Representatives: Average $47,082 annually, handling customer inquiries, processing transactions, and resolving basic issues

- Retail Sales Associates: Average $39,285, assisting customers with purchases and maintaining store operations

- Call Center Agents: Average $50,500, managing high-volume phone interactions

- Food Service Workers: $20,000-$35,000, though tips can substantially increase total compensation

- Hotel and Hospitality Associates: $28,000-$40,000, with opportunities in guest services and operations

- Bank Tellers: $35,000-$45,000, handling financial transactions and basic account services

- Medical Receptionists: $35,000-$50,000, managing patient scheduling and healthcare administration

Mid-Career Positions ($50,000-$85,000 annually)

Professionals with 3-5 years of experience typically transition into these roles:

- Senior Customer Support Specialists: $50,000-$75,000, managing complex cases and mentoring junior staff

- Team Leads and Supervisors: Average $60,521, overseeing small teams and handling escalations

- Tech Support Specialists: Average $72,621, requiring technical knowledge and problem-solving capabilities

- Client Relations Managers: Average $56,904, building and maintaining key customer relationships

- Insurance Agents: Base $55,000-$102,000, often with substantial commission potential

- Retail Store Managers: $50,000-$80,000, with responsibility for operations, staff, and profitability

Senior and Specialized Roles ($75,000-$150,000+ annually)

Experienced professionals and specialized experts command premium compensation:

- Customer Service Managers: Average $109,234, directing entire support organizations

- Customer Success Managers (Technology companies): $80,000-$120,000+, ensuring client retention and satisfaction

- Financial Advisors: $58,000-$108,000, providing investment and financial planning guidance

- Loan Officers: $66,000-$121,000, evaluating and approving lending applications

- Wealth Managers: $80,000-$149,000, managing high-net-worth client portfolios

- Healthcare Administrators: $90,000-$120,000, overseeing medical facility operations

- VP/Director of Customer Support: $120,000-$200,000+, setting strategic vision and managing large teams

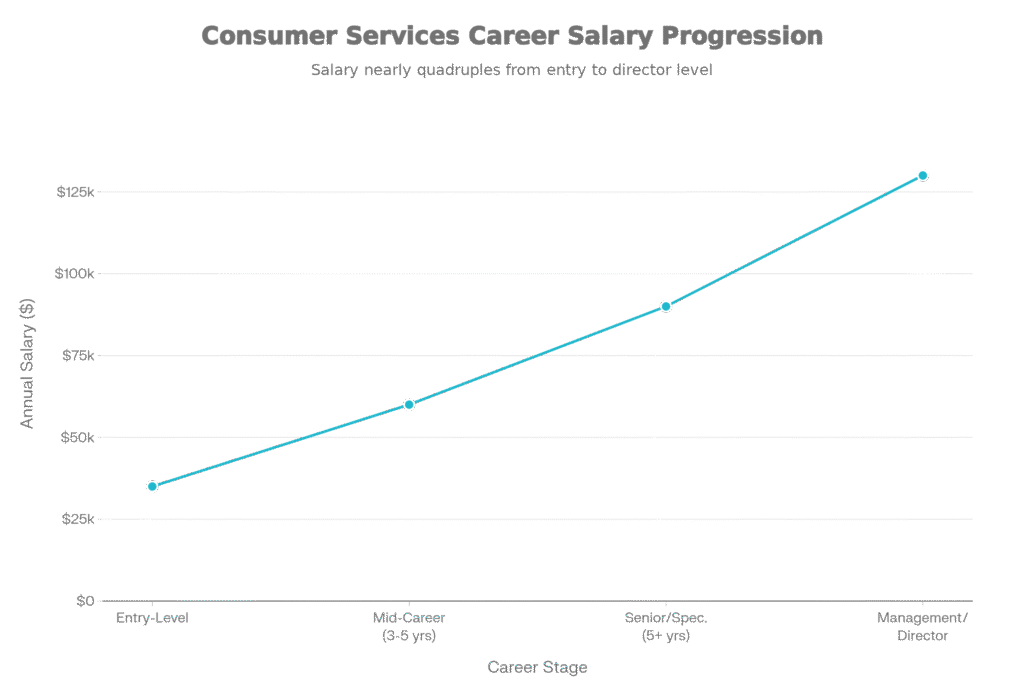

The salary trajectory demonstrates significant earning potential. Career progression can advance from $35,000 entry-level positions to $130,000+ management roles within 8-12 years through deliberate skill development and specialization.

Is Finance Consumer Services a Good Career Path?

Finance consumer services emerged as the highest-compensated subsector within consumer services, warranting dedicated analysis for career seekers interested in financial services.

Why Finance Consumer Services Stands Out

The financial services subsector commands exceptional compensation premiums. Average salaries exceed $72,250 annually—approximately 11% above the US median salary of $63,795. The highest-paying roles reach well into six figures:

- Financial Managers: $153,460 annually

- Chief Financial Officers: $142,619

- Wealth Managers: $80,000-$149,000

- Financial Advisors: $58,000-$108,000

- Loan Officers: $66,000-$121,000

Growth Projections and Job Security

Finance consumer services is projected to expand 8% between 2020 and 2030, driven by economic growth, globalization, and increasingly complex tax and regulatory systems. This growth rate exceeds overall employment projections, indicating strong, sustained demand.

Financial institutions employ hundreds of thousands across diverse roles: customer service representatives, loan officers, financial advisors, insurance agents, accountants, auditors, relationship managers, and compliance specialists. This diversity enables specialization and internal mobility throughout careers.

Key Advantages of Finance Consumer Services

Transferable Professional Skills: Finance and consumer services develop highly valued competencies, including financial analysis, risk assessment, regulatory knowledge, communication, and strategic thinking. These skills command premium compensation across industries and provide career insurance.

Business Impact and Advancement: Finance operates at the intersection of business strategy and customer relationships. Professionals develop a broad business understanding, enabling progression to senior leadership and C-suite roles with greater frequency than other consumer services sectors.

Specialization Opportunities: Finance subdivides into numerous specialties—wealth management, corporate finance, insurance, investments, and lending—each offering distinct career trajectories and compensation structures. Professionals can specialize based on interests and abilities.

Challenges to Consider

Higher Stress and Compliance Pressure: Finance roles operate under significant regulatory scrutiny, compliance requirements, and risk management pressures. Performance often ties to precise financial metrics, creating high-stakes environments.

Demanding Customer Base: Finance customers frequently present complex needs, significant financial pressure, and elevated expectations. Managing high-net-worth clients or distressed borrowers creates substantial emotional and intellectual demands.

Commission and Performance Dependency: Many finance roles incorporate commission structures, making income variable and performance-dependent. Underperforming quarters can substantially reduce compensation, creating financial uncertainty.

Specialized Credentials Required: Advancement to specialized roles often requires specific licenses, including Series 7/63/65 for investments, state banking licenses, or CFP certification for financial planning. These credentials require examination preparation and ongoing compliance education.

Market Volatility Exposure: Finance compensation and job security correlate with market conditions. During recessions or financial crises, the finance sector suffers disproportionate employment impacts.

The Verdict on Finance Consumer Services

Finance consumer services represents an excellent career path for candidates with interests in financial systems, strong analytical capabilities, relationship management orientation, and ambitious compensation goals. The growth projections, salary premiums, and skill transferability create compelling long-term opportunities that outpace general consumer services roles.

However, success requires psychological resilience for high-stress environments, professional discipline for regulatory compliance, and tolerance for market volatility exposure. Candidates should honestly assess whether these trade-offs align with their personalities and life priorities.

The Advantages of Consumer Services Careers

Consumer services offer demonstrable benefits for professionals with appropriate skill profiles and career preferences. Understanding these advantages helps determine whether the sector aligns with your goals.

Exceptional Job Security and Stability

Consumer services provide unmatched employment security based on a fundamental premise—consumers perpetually require assistance with purchasing decisions, service issues, and transaction processing. As long as customers exist and engage in commerce, skilled professionals remain essential. This represents a significant advantage over technology-dependent or capital-intensive sectors vulnerable to disruption.

Even during economic downturns, consumer services employment shows remarkable resilience. While specific companies may struggle, overall sector demand remains robust as consumers continue requiring essential services.

Multiple Advancement Pathways

Rather than linear progression, consumer services offer divergent career trajectories, accommodating different professional objectives:

- People Management Path: Progression from representative to supervisor, manager, and eventually director or VP roles

- Technical Specialization Path: Evolution into tech support, customer support engineering, and technical leadership positions

- Domain Expertise Path: Transition into specialized sectors like finance, healthcare, or technology customer services

- Entrepreneurial Path: Skills enabling independent consulting or business launches

Most advancement pathways can progress from entry-level to six-figure roles within 8-12 years through demonstrated excellence and continuous skill development.

Accessibility and Low Barriers to Entry

Unlike fields requiring advanced degrees or extensive prerequisites, consumer services welcome candidates with high school diplomas or associate degrees and minimal prior experience. This democratization of opportunity enables career entry for diverse populations, including recent graduates, career changers, and individuals facing employment barriers.

The sector’s accessibility doesn’t limit advancement potential. Entry-level accessibility combined with clear progression pathways creates genuine upward mobility opportunities.

Transferable Soft Skills Development

Positions develop universally valued competencies, including communication, problem-solving, empathy, conflict resolution, and relationship management applicable across all industries and career paths. These skills prove invaluable for lateral career movements or entrepreneurial ventures.

Even professionals who eventually leave consumer services report that the soft skills developed during their tenure significantly enhanced their capabilities in subsequent roles.

Global Opportunities and Remote Work

Consumer services operate on a genuinely global scale, creating opportunities for international work, travel, and exposure to diverse markets. Remote work expansion has further globalized the sector, with remote customer service positions ranging from $45,000-$160,000+, depending on specialization.

This flexibility enables professionals to earn coastal or major metropolitan salaries while maintaining lower cost-of-living lifestyles, creating significant financial advantages through geographic arbitrage.

Competitive Compensation in Specialized Roles

While entry-level positions offer modest salaries, specialized consumer services roles command highly competitive compensation. Finance consumer services professionals earn 33% above the US average, senior customer success managers at technology companies earn $80,000-$120,000+, and management roles exceed $109,000 annually.

Comprehensive Benefits Packages

Beyond base salaries, consumer services positions frequently include health insurance, paid time off, retirement contributions, performance bonuses, commission structures, and professional development opportunities. These additional benefits substantially enhance total compensation and provide financial security.

The Disadvantages and Challenges

Prospective candidates must acknowledge significant obstacles inherent in consumer services careers. Honest assessment of these challenges prevents future disappointment and enables informed decision-making.

Severe Burnout and Mental Health Risks

Research reveals alarming burnout statistics within consumer services. Approximately 74% of contact center agents face serious burnout risk, with 96% reporting high stress levels weekly. One Cornell University study found 87% of call center workers experienced “high” or “very high” stress while working, with 77% experiencing similar stress outside work.

The emotional labor of managing continuous customer interactions, meeting strict performance metrics, and de-escalating conflicts creates psychological strain without adequate organizational support. This manifests as anxiety, depression, sleep disruption, and physical health deterioration.

Work-Life Balance Deterioration

Shift work requirements, unpredictable schedules, weekend and evening obligations, and overtime demands characterize many consumer services positions, particularly in hospitality and call centers. Without strong boundaries, work obligations expand into personal time, creating chronic work-life conflict that undermines family relationships, social engagement, and personal development.

The inability to fully disconnect after shifts—particularly with always-on communication expectations—prevents genuine recovery and regeneration.

Low Entry-Level Compensation

Food service workers earn as little as $20,000 annually, while retail positions often start at $30,000-$35,000. Adjusting for cost-of-living in major metropolitan areas, these wages provide minimal financial security and can require supplementary income or government assistance.

Repetitive and Monotonous Work

Many consumer service roles involve repetitive question-answering, identical issue resolution, and routine transaction processing. Without creative problem-solving or variety, work becomes monotonous, diminishing engagement and motivation over time.

Significant Automation and Job Displacement Risk

The sector faces unprecedented technological disruption. By 2025, 95% of customer interactions are expected to be AI-powered, with 80% of customer service organizations implementing generative AI. By 2026, Gartner projects 10% of agent interactions will be fully automated, and by 2027, 25% of organizations may use chatbots as their primary customer service channel.

Broader automation analysis suggests 10-30% job loss risk in North American retail and customer service roles, with 800 million jobs potentially displaced globally by 2030. The Bureau of Labor Statistics projects a concerning 5% decline in traditional customer service representative positions between 2023-2033, representing approximately 148,800 lost jobs.

Customer Hostility and Emotional Abuse

Service workers increasingly encounter aggressive, hostile, or abusive customer interactions, particularly post-pandemic. Without organizational support, protection, and conflict resolution training, this emotional abuse creates lasting trauma and reduces job satisfaction.

High Industry Turnover

Consumer services show among the highest resignation rates of any sector. Retail, accommodation, and food services experience resignation rates 26% higher than the US national average, suggesting systemic dissatisfaction despite industry growth.

Skills Required for Consumer Services Success

Success in consumer services requires specific technical competencies combined with essential behavioral skills. Understanding these requirements helps candidates assess their fit and identify development needs.

Hard Technical Skills

Successful consumer services professionals require specific technical competencies, including:

- Help desk software (ticketing systems, email management, chat platforms)

- Customer Relationship Management (CRM) systems like Salesforce or HubSpot

- Phone systems and call management technology

- Point-of-sale (POS) systems for retail environments

- Microsoft Office Suite proficiency

- Data analysis and reporting tools for performance tracking

- Product or service-specific technical knowledge

- Familiarity with emerging AI customer service tools

Essential Soft Skills

Soft skills distinguish exceptional consumer service professionals from adequate performers:

Communication: Clear, professional written and verbal expression across diverse communication channels, adapting style to audience needs

Problem-Solving: Logical analysis and creative solution development under pressure, often with incomplete information

Empathy: Genuine understanding of customer perspectives and emotional intelligence to recognize unspoken needs

Active Listening: Comprehension of customer needs beyond surface requests, asking clarifying questions

Patience: Maintaining composure with difficult interactions, even when customers express frustration inappropriately

Resilience: Recovery from rejection, criticism, or failure without psychological deterioration

Time Management: Balancing multiple tasks and priorities simultaneously without compromising quality

Conflict Resolution: De-escalating tense situations and finding mutually acceptable solutions

Adaptability: Responding flexibly to changing circumstances, technologies, and requirements

Customer Relationship Building: Creating loyalty and positive brand associations through consistent, quality interactions

Emerging Critical Competencies

As automation reshapes the sector, new competencies become increasingly valuable:

- Data Analysis and Interpretation: Understanding customer behavior metrics and performance dashboards

- AI Tool Proficiency: Managing and optimizing AI customer service platforms rather than competing with them

- Specialized Domain Expertise: Deep knowledge in healthcare, finance, technology, or other specialized domains

- Leadership and Mentorship: Preparing for supervisory roles, managing AI-augmented teams

- Emotional Intelligence: Managing complex human relationships when AI handles routine interactions

Professionals who develop these emerging competencies position themselves for automation-resistant roles commanding premium compensation.

Education, Certifications, and Career Development

Consumer services accommodate diverse educational backgrounds while offering structured advancement through professional certifications and training programs.

Minimum Educational Requirements

Consumer services positions accommodate diverse educational backgrounds. Entry-level roles require only a high school diploma or equivalent, creating immediate employment accessibility. However, advancement to management and specialized roles benefits from additional credentials:

- Associate Degree: Position holders for faster advancement to supervisory roles, particularly in healthcare and financial services

- Bachelor’s Degree: Increasingly expected for management, director, and specialized roles; provides significant career acceleration

- MBA or Advanced Business Degree: Expected for C-suite positions in large organizations

Valuable Professional Certifications

Professional certifications validate expertise and enhance career competitiveness. Leading certifications include:

Comprehensive Customer Service Certifications:

- Certified Customer Service Professional (CCSP): Comprehensive service skills validation; requires 3+ years of experience; $247 exam fee

- Certified Support Professional (HDI-CSP): Industry-recognized foundational certification; $549+

- Customer Service Excellence Certification: National Customer Service Association credential; requires 2+ years of experience; $345+ exam fees

Specialized Certifications:

- Call Center Associate Certified (CCAC): Specific to call center operations

- HDI Customer Service Representative (HDI-CSR): Foundational skills validation; $549+

- Customer Service Manager Certificate (CSMC): Targets aspiring managers; addresses leadership and team management

- Certified Client Service Specialist (CCSS): Focuses on client relationship enhancement

- Customer Experience Certification (CCXPA): Deep expertise in customer experience design and strategy; requires post-secondary education; $495-$645

Finance Consumer Services Certifications:

- Series 7, Series 63, or Series 65 licenses for securities/investment roles

- Financial Planning Certification (CFP)

- State-specific banking and insurance licenses

Employer-Provided Training Programs

Many major consumer services employers offer comprehensive in-house training and development programs. TTEC’s “BUILD program,” for example, teaches technical and soft skills plus management insights, facilitating fast-track career advancement. Similarly, large retailers and financial institutions provide structured advancement programs.

Certification costs range from minimal (free online courses) to substantial ($2,250+ for comprehensive leadership programs). Many employers subsidize or fully fund relevant certifications as professional development investments.

Career Advancement Pathways and Timelines

Consumer services careers accommodate diverse advancement strategies depending on individual goals and strengths.

Linear Management Pathway (Most Common)

The traditional hierarchy offers clear progression:

- Customer Service Representative → Handles customer inquiries, processes transactions, resolves issues, and builds foundational customer interaction skills

- Senior Representative/Specialist → Manages more complex cases, mentors newer staff, develops expertise; increased responsibility without formal team oversight

- Team Lead/Supervisor → Manages small team (5-15 people), provides guidance, monitors performance metrics, handles escalations; introduction to people management

- Manager → Oversees larger teams (20-100+ people), develops service strategies, manages budgets, contributes to departmental decisions; expanded strategic influence

- Director/VP of Customer Service → Sets vision for entire support organization, manages multiple teams, handles budget allocation, reports to C-suite; strategic leadership level

Technical Specialization Pathway

For technically-inclined professionals:

Customer Service Representative (general) → Tech Support Specialist → Customer Support Engineer → Technical Leadership/Architecture role

This pathway emphasizes specialized technical knowledge rather than people management, commanding comparable compensation ($100,000+) without managerial responsibilities.

Domain-Specific Advancement

Professionals can transition from general customer service into specialized, high-paying sectors:

- General Customer Service → Financial Services Specialist → Loan Officer/Financial Advisor → Wealth Manager ($80,000-$149,000+)

- Hospitality Associate → Hotel Manager → Regional Director

- Healthcare Support → Patient Advocate → Healthcare Administrator

Cross-Industry Movement

Skills developed in consumer services transfer readily across industries, enabling lateral career moves. An exceptional customer service professional from retail can transition to healthcare customer support, financial services, or technology sectors—often with significant salary increases.

Timeline Expectations

Advancement timelines vary significantly based on organization, individual performance, and economic conditions:

- Entry-level to Team Lead: 3-5 years (accelerated performers may achieve in 2-3 years)

- Team Lead to Manager: 2-4 years

- Manager to Director: 3-5 years

- Director to VP/C-Suite: 5-10+ years

High-performing individuals in organizations with strong internal promotion cultures can reach management roles within 5-8 years.

Automation, AI, and Future Challenges

Consumer services face unprecedented technological disruption that fundamentally reshapes career prospects and job security.

Current AI Integration and Impact (2024-2025)

The integration of artificial intelligence into customer service operations has accelerated beyond previous projections. Organizations investing in AI customer service experience compelling returns, with companies reporting average returns of $3.50 for every $1 invested in AI customer service, with leading organizations achieving up to 8x ROI.

Customer Satisfaction (CSAT) improvements through AI average 12% increases, while integration with CRM systems yields 35% satisfaction improvements, and AI-powered personalization adds 27% CSAT gains. These metrics drive continued investment and deployment acceleration.

Job Displacement Projections

The potential job displacement in consumer services represents a critical career consideration:

- Short-term (2025-2027): Primarily affects routine, transactional roles including data entry, basic support inquiries, order processing, and simple transaction handling

- Medium-term (2028-2030): Bain & Company analysis suggests 20-25% of current US jobs may be eliminated (40 million workers), with the service sector experiencing 2-3x faster job loss than previous technological transitions

- Global Context: Worldwide, automation could displace 800 million workers by 2030 (30% of the global workforce), though 555 million new jobs might be created, representing significant sectoral reallocation

Roles Most Vulnerable to Automation

- Basic customer support and inquiry handling

- Data entry and transaction processing

- Order taking and simple transactions

- Routine billing inquiries

- FAQ-response roles

- Basic problem diagnosis

- Transactional back-office work

Roles Resilient to Automation

- Complex problem-solving requires strategic thinking

- High-emotion interactions requiring genuine empathy

- Relationship-intensive account management

- Specialized domain expertise (financial planning, healthcare counseling)

- Leadership and team management

- Customer experience strategy and design

- AI system management and optimization

- Training and mentorship roles

- Specialized technical support requiring deep expertise

Strategic Response Requirements

Professionals planning consumer services careers must proactively address automation threats:

- Specialize in High-Value, Automation-Resistant Skills: Focus on complex problem-solving, relationship building, and emotional intelligence rather than routine transaction processing

- Develop AI Fluency: Understand and optimize AI customer service platforms rather than compete with them. AI management and optimization represent an emerging, high-value specialization.

- Pursue Management and Leadership: People management roles remain substantially automation-resistant. Team leadership, strategy, and organizational development offer greater security.

- Build Domain Expertise: Deep specialization in healthcare, finance, legal, or technical domains creates barriers to automation and commands premium compensation.

- Embrace Continuous Learning: The rate of technological change necessitates ongoing skill development and certification. Organizations investing in employee development demonstrate greater long-term viability.

- Transition Earlier Rather Than Later: Mid-career professionals should upskill or transition to specialized roles before automation pressure becomes acute.

Remote Work and Flexible Opportunities

The pandemic accelerated remote work adoption in consumer services, creating unprecedented flexibility opportunities.

Remote Work Prevalence

Remote consumer services positions have expanded substantially. Remote customer service jobs range from $45,000-$160,000+, depending on specialization:

- General customer service: $45,000-$80,000

- Tech support and specialized: $70,000-$120,000

- Management and leadership: $100,000-$160,000+

- Highly specialized finance/healthcare: $120,000-$300,000+

Major Remote-Offering Companies

- Working Solutions (independent contractor model with complete scheduling flexibility)

- Amazon (100% remote customer service positions)

- Sun Life Financial (hybrid remote options)

- GEICO (hybrid and remote customer service roles)

- Tech companies (Salesforce, Microsoft, ServiceNow, offering remote customer success roles)

Advantages of Remote Consumer Services

- Geographic Arbitrage: Earning coastal or major metropolitan salaries while maintaining lower cost-of-living lifestyles

- Schedule Flexibility: Ability to structure work around personal responsibilities

- Reduced Commute Stress: Eliminating the daily transportation burden

- Home Environment Control: Customizing workspace for comfort and productivity

- Family Accommodation: Managing child care, elder care, and personal responsibilities without workplace inflexibility

- Broader Job Market Access: Accessing opportunities beyond geographic proximity

Challenges of Remote Consumer Services

- Isolation: Reduced social interaction and team connection

- Boundary Blurring: Difficulty separating work and home life

- Technical Requirements: Reliable internet, dedicated workspace, and appropriate equipment necessary

- Management Scrutiny: Some employers employ invasive monitoring software to track activity and communication

- Reduced Career Visibility: Remote employees sometimes experience advancement disadvantages compared to in-office staff

- Equipment Costs: Home office setup and maintenance expenses (though many employers provide equipment)

Strategic Recommendations for Different Career Stages

For Career Starters and Younger Professionals

- Pursue Consumer Services as Foundation: Use entry-level positions to develop soft skills, build a work ethic, and explore career interests while maintaining minimal financial risk.

- Specialize Rapidly: Don’t remain in generic customer service roles. Move toward specialized domains (finance, healthcare, technology) within 2-3 years, where automation resistance and compensation premiums increase.

- Develop Technical Competence: Build proficiency with AI tools, CRM systems, and data analysis platforms to become automation-proof

- Plan for Management: Identify whether leadership interests you, and if so, pursue supervisory roles by year 3-5 while you have energy and few external obligations

- Build Geographic Advantage: Early career positions in growth regions (Nevada, Colorado, Minnesota) offer less competition and can establish strong advancement platforms.

For Career Changers

- Leverage Transferable Skills: Your existing soft skills (communication, problem-solving) accelerate advancement beyond typical entry-level timelines.

- Pursue Niche Specializations: Target high-value specializations (finance, healthcare, technology, customer support) where your domain expertise commands immediate premium compensation.

- Select Remote-First Employers: Maximize flexibility and maintain previously established professional networks while transitioning.

- Set Clear Advancement Timelines: Establish specific targets for management roles or specialization within defined timeframes, preventing indefinite plateau.

For Mid-Career Professionals

- Evaluate Current Trajectory: If in routine customer service roles without a clear advancement pathway, proactively transition to specialized roles or management tracks.

- Develop Leadership Capability: Identify succession planning opportunities and pursue formal leadership training programs.

- Build Financial Reserves: Develop sufficient savings to enable employment transition without desperation if burnout or automation threatens your role.

- Specialize or Transition: Pursue either domain expertise within consumer services (healthcare, finance, technology) or transition to related fields, leveraging your skills.

For Finance Consumer Services Candidates

- Pursue Specialized Certifications: Obtain Series licenses, CFP certification, or specialized banking credentials early.

- Target High-Value Niches: Wealth management, financial planning, and institutional finance offer superior compensation and automation resistance compared to basic customer service

- Develop Client Relationships: Build deep, sticky customer relationships that create personal switching costs and job security.

- Maintain Compliance Excellence: Financial services demand rigorous compliance and regulatory adherence—embrace this rather than view it as a burden.

Frequently Asked Questions (FAQs)

1. Is consumer services a stable career choice in the age of automation?

Consumer services offer stability, but with important caveats. While 95% of customer interactions are expected to involve AI by 2025, automation primarily threatens routine, transactional roles. Positions requiring complex problem-solving, emotional intelligence, specialized domain knowledge, and leadership remain highly secure. The key is continuous upskilling and specialization into automation-resistant areas like healthcare services, financial advising, technical support, and management. Professionals who develop AI management skills and emotional intelligence will thrive, while those in basic inquiry-handling roles face displacement risk.

2. How much can you realistically earn in consumer services?

Earnings vary dramatically by specialization and experience. Entry-level positions typically pay $30,000-$50,000 annually, mid-career roles range from $50,000-$85,000, and senior specialized positions command $75,000-$150,000+. Finance consumer services professionals earn average salaries exceeding $72,250—11% above the US median—with top roles like Financial Managers earning $153,460 and Wealth Managers reaching $80,000-$149,000. Career progression from entry-level to director-level positions can nearly quadruple earnings over 8-12 years with strategic specialization and consistent performance.

3. What’s the biggest challenge working in consumer services?

Burnout represents the most significant challenge. Research shows 74% of contact center agents face serious burnout risk, with 96% reporting high stress weekly. The emotional labor of managing continuous difficult interactions, meeting strict performance metrics, handling customer hostility, and working irregular schedules creates psychological strain. Successful professionals implement strict boundaries, prioritize mental health, choose supportive employers, and strategically move into specialized or management roles that offer greater autonomy and reduced direct customer conflict. Organizations with strong wellness programs and reasonable workloads significantly improve sustainability.

4. Do you need a college degree for consumer services careers?

Entry-level consumer services positions generally require only a high school diploma or equivalent, making the field highly accessible. However, advancement potential increases significantly with higher education. Associate degrees accelerate progression to supervisory roles, bachelor’s degrees are increasingly expected for management and specialized positions, and MBAs open doors to C-suite opportunities. Professional certifications (CCSP, HDI-CSP, CFP for finance roles) often provide comparable value to degrees for mid-career advancement. Many successful professionals enter with minimal education and pursue additional credentials while working, using employer tuition reimbursement programs.

5. Which consumer services specialization offers the best career prospects?

Finance, consumer services, and healthcare services currently offer the strongest prospects. Finance roles provide exceptional compensation averaging $72,250+ annually, with 8% employment growth projected through 2030. Healthcare services are projected to add 2.1 million jobs (45% of all new US employment), driven by aging populations and technological advancement. Technology customer success roles also show strong prospects with $80,000-$120,000+ salaries. These specializations offer superior automation resistance, higher compensation, transferable skills, and clear advancement pathways compared to general retail or hospitality positions.

Final Verdict: Is Consumer Services a Good Career Path?

Consumer services represent a viable and potentially excellent career path for individuals who approach it strategically. The sector offers genuine advantages: exceptional job security rooted in perpetual consumer demand, multiple advancement pathways accommodating diverse career goals, accessible entry points requiring minimal credentials, transferable skill development valuable across all industries, and strong salary potential for specialized roles reaching $100,000-$150,000+.

The US consumer services market of $3.7 trillion, with 140 million workers, demonstrates remarkable economic significance and employment breadth. Healthcare services alone will add 2.1 million jobs—representing 45% of all new US employment—while finance and consumer services offer 8% growth with premium compensation.

However, success demands honest acknowledgment of substantial challenges. Burnout affects 74% of contact center agents. Entry-level wages often provide minimal financial security, and automation threatens 10-30% of routine customer service roles, potentially displacing 800 million jobs globally by 2030.

Consumer services functions as either an excellent career foundation or a problematic long-term commitment depending on specialization choice, organizational support, and strategic career planning. Professionals who specialize in high-value domains (such as finance, healthcare, and technology), develop AI fluency, pursue management tracks, and maintain strong boundaries will thrive. Those who remain in routine roles without deliberate skill development face increasing precarity as automation accelerates.

For individuals seeking accessible career entry with clear advancement potential, strong interpersonal skills, and an interest in helping others, consumer services offer a genuine opportunity. Approach it with strategy, specialize early, embrace continuous learning, and you’ll find a sector that rewards excellence with security, flexibility, and substantial earning potential.